It's Nice To Meet You!

Hey, I’m Sarah—a financial coach, full-time RVer, and creative entrepreneur who believes your money should support your life, not stress you out.

I help high earners, professionals, and business owners eliminate debt, organize their finances, and finally feel in control—using a values-based, custom approach that actually fits your real life.

Who Do I Help?

High-income professionals who feel like they “should” be further ahead

Business owners who want to offer real financial wellness to their teams

Anyone ready to ditch debt, get organized, and spend according to their values

How Do I Help?

Through The 6 Pillars of Finance!

My approach covers every area you need to finally feel at peace with your money and build solid financial foundations:

Creating Money: Increase your income and opportunities

Saving Money: Build your Peace of Mind Fund (no more emergencies!)

Spending Money: Spend with intention, not guilt

Investing Money: Start where you are, grow as you go

Giving Money: Make an impact, big or small

Organizing Money: Systems that make your life easier

"Thank you for this.

I needed this guidance because for the first time, I have extra money for myself and I just didn't know what to do with it. Thank you for redirecting me to those three priorities! I am blessed to have you in my life."

~Client R

"We've been able to talk without as much contention.

This has been such a game changer in our lives. Being able to learn more about how we communicate and putting together a money plan that leads us to the goals we set."

~Clients M&M

"I don't feel like I have to ask permission to buy something.

Because of your help, I feel so much more confident with our money decisions and I no longer feel guilty for spending money on the things I want. We've paid cash for Christmas for the first time ever and it feels great!"

~Clients N&J

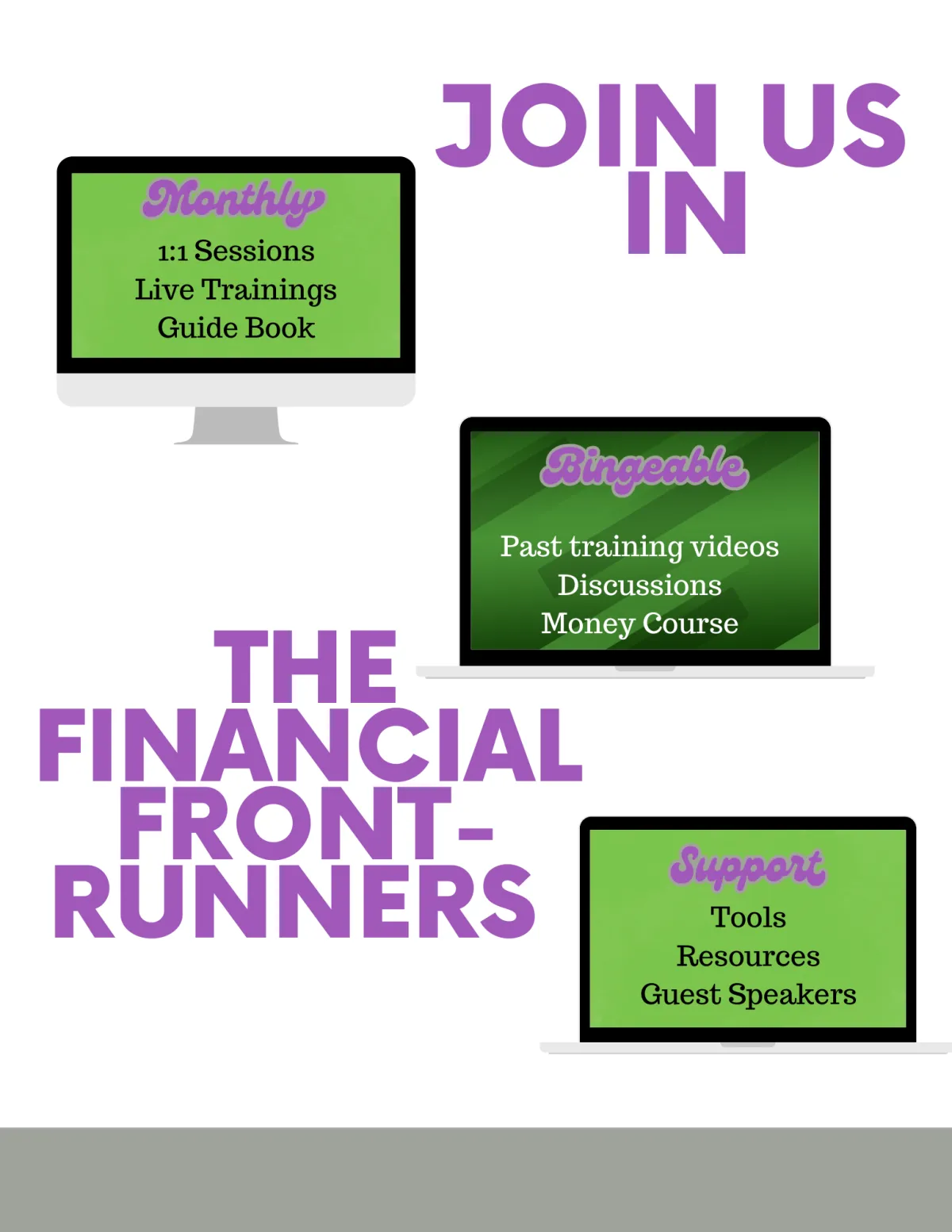

My Signature Programs

Not sure where to start?

Book a FREE call - let's talk about your goals and map out your next steps.

Why Keeping Up With The Joneses?

We Don't Live in the Land of Restriction

This is about spending more money in the areas that bring value to your life and lead you to the life you deserve.

Shame and Guilt - Be Gone!

These feelings are holding you back from seeing what is truly possible with your money.

WE have Peace of Mind - Not Emergencies

Emergencies create a negative reaction within your body. That shouldn't be tied to your money. So we create Peace Of Mind instead.

Judgement Free Zone

You have enough judgement in your life. You won't find any here!

Sugar Coating is for Candy

Not your money situation. I am bold with my coaching so you have the BEST opportunity for growth.

We Celebrate!

Not just the BIG wins but the little steps you take to make huge changes long term.

Sick of hearing this too?

About My Other Ventures

I’m also a multi-business owner (including custom metal prints and wellness products)—because I believe in building a life and income that supports your dreams.

But my true passion? Helping you get your money working for you, so you can live your version of freedom.

Ready to get out of debt, get organized, and make your money work for you?

Book your free consultation now and start your journey to financial peace—on your terms.

Serving clients nationwide—specializing in debt elimination, financial coaching for high earners, values-based money plans, and financial wellness for business owners.